This industry overview will discuss the latest statistics and trends for Home Care Providers in Canada. For a definition of Home Care please click here.

Photo Credit: Photo by Bejamin Balazs from Pixabay

Key Takeaways

- Canada’s Aging Population: An ever-increasing percentage of Canada’s national population is comprised of adults aged 65 and older.

- Rapidly Growing Elderly Population: Canada’s elderly population is growing faster than the national population growth rate.

- Patient Preferences: Canada is experiencing a shift away from institutionalized care and towards home care.

- Strong Demand: The elderly generally have higher levels of disposable income and can pay out of pocket. This helps to sustain demand for industry services.

- Industry Growth: Strong demand from Canada’s elderly population has been a key driving force behind industry growth in recent years.

For more specific information about researching the Canadian health care industry and the elderly, please see our Home Care Providers Guide. If you are looking for information specific to British Columbia scroll down to the section titled “Snapshot of British Columbia” on this page.

Industry Structure

- Industry phase: GROWTH

The shift toward home health care over institutionalized health care, along with Canada’s ever-growing elderly population has helped to sustain industry growth (Gonzalez, 2018).

- Concentration level: LOW

Canada’s top industry players accounted for less than 30% of total industry revenue in 2018 (Gonzalez, 2018)

- Regulation level: MEDIUM

Accreditation Canada offers accreditation to industry operators that demonstrate acceptable levels of care (Gonzalez, 2018)

- Barriers to entry: MEDIUM

Potentially significant barriers to entry include licensing and accreditation requirements, as well as a high degree of competition (Gonzalez, 2018)

- Competition level: HIGH

Industry players compete on brand reputation, quality of service, and price. Home care providers also compete with hospitals, nursing facilities, hospices (Gonzalez, 2018).

Industry Performance Snapshot

During 2013-2018:

- Adults aged 65 and older currently account for more than 46% of national spending on healthcare in Canada (Gonzalez, 2018).

- Approximately 70% - 80% of home care services in Canada were provided by unregulated health care workers (CHCA, 2016).

- In 2016, 425,750 or 1.2% of Canadians lived in nursing homes or residences for senior citizens. However, Canada is experiencing a shift away from institutionalized forms of care and toward home care (Statistics Canada – The Daily, 2017).

- Total expenditure rose by an annualized rate of 3.1% over the previous five years, reflecting the high demand for home health care services (Gonzalez, 2018).

- Industry wages grew by an annualized rate of 3.2% to $2.4 billion over the past five years (Gonzalez, 2018).

Industry Outlook

For the period 2018-2023:

- Industry revenue is expected to grow at an annualized rate of 3.0% to $4.8 billion (Gonzalez, 2018).

- Industry wages are expected to grow at an annualized rate of 3.5% (Gonzalez, 2018).

- Canada’s elderly population is expected to grow at an annualized rate of 3.4% (Gonzalez, 2018).

- 20% of Canada’s population will consist of adults aged 65 and older by 2023/24 (Statistics Canada, Transitions, 2018).

Products and Services

Gonzalez, E. (2018). IBISWorld Industry Report 62161CA: Home Care Providers in Canada.

Key Markets

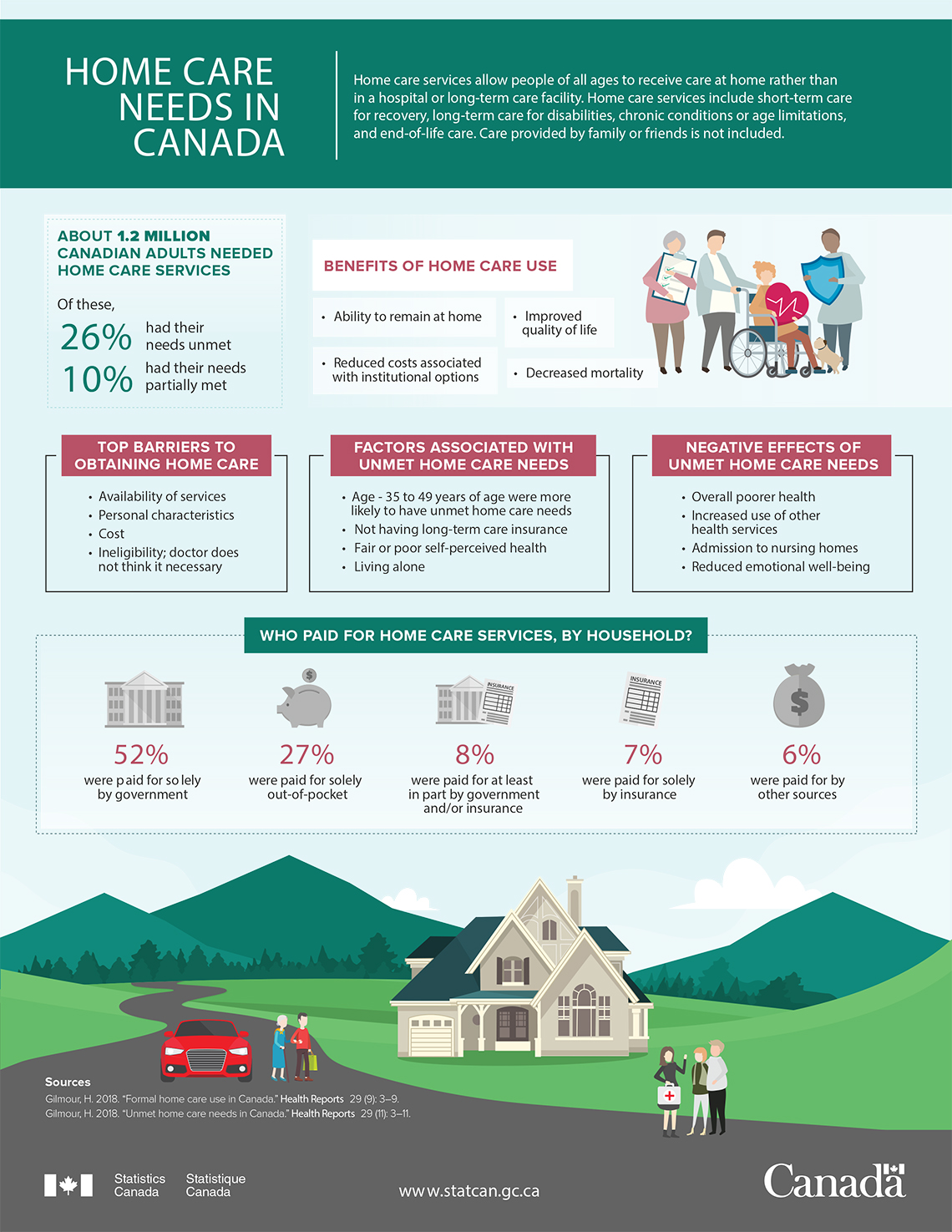

Statistics Canada. (2018, November 21). Home Care Needs in Canada.

Gonzalez, E. (2018). IBISWorld Industry Report 62161CA: Home Care Providers in Canada.

Cost Breakdown

Gonzalez, E. (2018). IBISWorld Industry Report 62161CA: Home Care Providers in Canada.

Business Locations

Gonzalez, E. (2018). IBISWorld Industry Report 62161CA: Home Care Providers in Canada.

Trends & Changes

Aging Population

- Canadians aged 65 or older account for 5,935,635 or 16.9% of the national population (Grant & Agius, 2017).

- Canadians aged 75 and older (of which 9% live in residential care) account for 2.6 million of the national population. This figure is expected to double over the next 20 years (CIHI, 2017).

- Canadians aged 85 and older account for 770,780 or 2.2% of the national population (Statistics Canada, Age and Sex, 2016).

- Canada’s elderly population continues to growing at a faster rate than the national population growth rate. Demand for home care services will thus remain strong (Gonzalez, 2018).

- The number of Canadians aged 65 or older is expected to reach 20% of the national population by 2023 (Gonzalez, 2018) and 27.8% by 2063 (Statistics Canada, 2015).

Generational Shift: More Seniors Than Children

- In 2016, there were 5.9 million Canadians aged 65 and over, compared with 5.8 million Canadians aged 14 or younger. As a result there are more seniors than children in Canada (Statistics Canada – The Daily, 2017).

- The share of seniors (16.9%) is greater than the share of children (16.6%). Canada’s aging population bodes well for industry demand (Statistics Canada – The Daily, 2017).

Funding Pressure

- During 2018-2023, pressure from government payers and private insurers is expected to slow industry growth (Gonzalez, 2018).

- Canada’s new Health Accord is also expected to slow industry growth. Less funding will affect health care companies’ profit margins (Gonzalez, 2018).

- The decline in funding will not deter the entry of new home care companies. An annualized rate of 3.4% over the next five years is forecasted (Gonzalez, 2018).

- Despite the decline in funding, Canada is forecasted to have a total of 3,169 home care companies in 2023 (Gonzalez, 2018).

Snapshot of British Columbia

- Health Care and Social Assistance industry sector — of which Home Care is a part — experienced 4% growth during 2016-2017 (WorkBC, n.d.).

- 11900 new jobs were created during 2016-2017, increasing total employment to 303,500 in Health Care and Social Assistance (WorkBC, n.d.).

- In 2016, approximately 853,000 seniors lived in BC. One-sixth of the province’s population was over 65 years old (BC Ministry of Health, 2017).

- 92% of seniors have a primary care physician, meaning that primary care is still the primary form of health care delivery in BC (BC Ministry of Health, 2017).

- Demand for home support services continues to increase. Approximately 20,000 seniors received home support services in 2016 (BC Ministry of Health, 2017).

- Demand for assisted living is strong, with 4,408 subsidized registered living units in the province as of March 2016 (BC Ministry of Health, 2017).

- During 2017-2021 the Ministry of Health is forecasted to spend an additional $500 million on home and community care. This additional spending reflects the increased demand for home care services in BC (BC Ministry of Health, 2017).

Care Options in British Columbia

There are a number of alternative care and support services related to the home care providers industry that are available to those living in BC. These services include:

- Community Nursing

- Community Rehabilitation

- Adult Day Services

- Choices in Supports for Independent Living (CSIL)

- Caregiver Respite/Relief

- End-of-Life Care Services

- Assisted Living

- Group Homes

- Family Care Homes

- Short-term Residential Care

- Long-term Residential Care

Sources

BC Ministry of Health. (2017). An Action Plan to Strengthen Home and Community Care for Seniors. Retrieved from: http://www.health.gov.bc.ca/library/publications/year/2017/home-and-community-care-action-plan.pdf

Canadian Home Care Association, College of Family Physicians of Canada, & Canadian Nurses Association. (2016). Better Home Care in Canada: A National Action Plan. Retrieved from: https://www.cna-aiic.ca/-/media/cna/page-content/pdf-en/better-home-care-in-canada_a-national-action-plan-copy.pdf?la=en&hash=D7C8B69F4E0B000F74CE372D6DAFCA9D198ADD39

Canadian Institute for Health Information. (2017). Seniors in Transition: Exploring Pathways Across the Continuum. Retrieved from: https://www.cihi.ca/sites/default/files/document/seniors-in-transition-report-2017-en.pdf

Gonzalez, E. (2018). IBISWorld Industry Report 62161CA: Home Care Providers in Canada. Retrieved from IBISWorld Industry Reports database.

Grant, T., & Agius, J. (2017, May 3). Census 2016: The Growing Age Gap, Gender Ratios and Other Key Takeaways. The Globe and Mail. Retrieved from: https://www.theglobeandmail.com/news/national/census-2016-statscan/article34882462/

Statistics Canada. (2018, November 21). Home Care Needs in Canada. Retrieved from: https://www150.statcan.gc.ca/n1/pub/11-627-m/11-627-m2018031-eng.htm

Statistics Canada. (2018, May 16). Transitions to Long-term and Residential Care Among Older Canadians. Retrieved from: https://www150.statcan.gc.ca/n1/pub/82-003-x/2018005/article/54966-eng.htm

Statistics Canada. (2017, May 3). 2016 Census Topic: Age and Sex. Retrieved from: https://www12.statcan.gc.ca/census-recensement/2016/rt-td/as-eng.cfm

Statistics Canada. (2015, May 26). Population Projections for Canada (2013 to 2063), Provinces and Territories (2013 to 2038). Retrieved from: https://www150.statcan.gc.ca/n1/pub/91-520-x/2014001/hi-fs-eng.htm

The Daily – Statistics Canada. (2017, May 3). Age and Sex, and Type of Dwelling Data: Key Results from the 2016 Census. Retrieved from: https://www150.statcan.gc.ca/n1/daily-quotidien/170503/dq170503a-eng.htm

WorkBC. (n.d). Health Care and Social Assistance. Retrieved from: https://www.workbc.ca/Labour-Market-Information/Industry-Information/Industry-Profiles/Health-Care-and-Social-Assistance

Supplementary Resources

Canadian Medical Association. (2016). The State of Seniors in Canada. Retrieved from: https://www.cma.ca/sites/default/files/2018-11/the-state-of-seniors-health-care-in-canada-september-2016.pdf

PwC. (n.d.). Global Top Health Industry Issues. Retrieved from: https://www.pwc.com/gx/en/industries/healthcare/top-health-industry-issues.html

Statistics Canada. (2019, February 21). Primary Health Care Providers, 2017. Retrieved from: https://www150.statcan.gc.ca/n1/pub/82-625-x/2019001/article/00001-eng.htm

Statistics Canada. (2018, November 21). Unmet Home Care Needs in Canada. Retrieved from: https://www150.statcan.gc.ca/n1/pub/82-003-x/2018011/article/00002-eng.htm

Statistics Canada. (2018, September 19). Formal Home Care Use in Canada. Retrieved from: https://www150.statcan.gc.ca/n1/pub/82-003-x/2018009/article/00001-eng.htm

Statistics Canada. (2017, May 3). 2016 Census Topic: Type of Dwelling. Retrieved from: https://www12.statcan.gc.ca/census-recensement/2016/rt-td/td-tl-eng.cfm

Statistics Canada. (2016). Employment Income Statistics (7), Occupation - National Occupational Classification (NOC) 2016 (193A), Work Activity During the Reference Year (9) and Sex (3) for the Population Aged 15 Years and Over in Private Households of Canada, Provinces and Territories and Census Metropolitan Areas, 2016 Census - 25% Sample Data.