The Canadian bakery industry involves the on-site manufacturing of baked products. These products can include but are not limited to bagels, bread, cakes, croissants, doughnuts, and pastries. This industry overview will discuss the latest statistics and trends for the bakery industry in Canada. For more information on the bakery industry please see our Bakery Guide.

Photo credit: Photo by Pexels

Key Takeaways

- Modest Growth: The Canadian bakery product market grew by a compound annualized rate of 2.2% during 2013-2017 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Modest Outlook: The Canadian bakery product market is expected to grow at a compound annualized rate of 3.4% from 2018-2022 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Food Intolerances: Gluten-free is the fastest growing food intolerance category in Canada (Agriculture and Agri-Food Canada, “Gluten Free”, 2014).

- Celiac Disease: Canadians with Celiac disease are a small, but important segment of the market for gluten-free bakery products (Agriculture and Agri-Food Canada, “Gluten Free”, 2014; Health Canada, 2018).

Industry Performance Snapshot

During 2013-2017:

- Retail sales of baked goods grew from $3.2 billion (USD) in 2013 to $3.5 billion (USD) in 2017 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Per capita expenditure on baked goods increased from $146.7 (USD) in 2013 to $153.5 (USD) in 2017 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

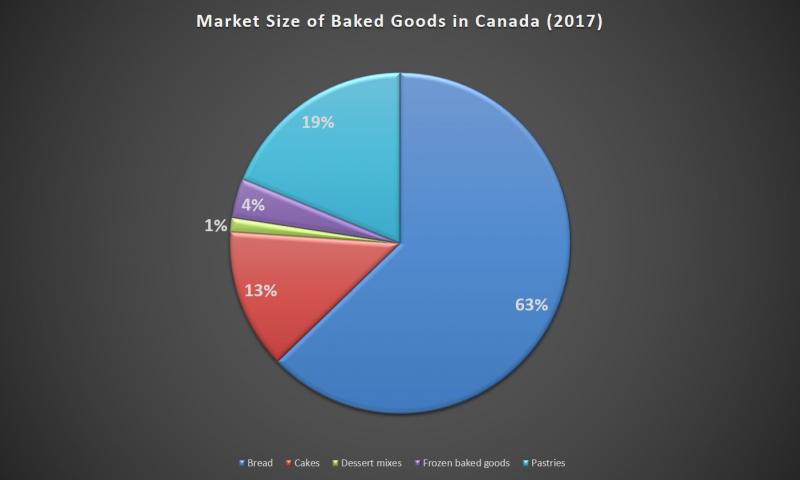

- Bread sales accounted for the largest portion of baked goods sales each year. In 2017, bread sales accounted for $3.5 billion (USD) or almost 63% of total sales that years (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

Source: Agriculture and Agri-Food Canada. (2018). Sector Trend Analysis – Baked Goods in the United States and Canada. Retrieved from: http://www.agr.gc.ca/eng/industry-markets-and-trade/international-agri-food-market-intelligence/reports/sector-trend-analysis-baked-goods-in-the-united-states-and-canada/?id=1537381272039

Industry Outlook

For the period 2018-2022:

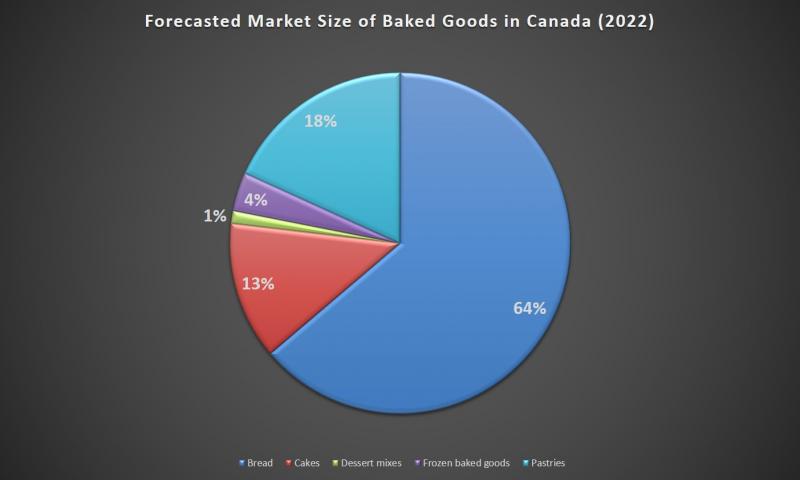

- Retail sales of baked goods are expected to grow by a compound annualized growth rate of 3.4%, reaching $6.6 billion (USD) in 2022 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Per capital expenditure on baked goods is expected to increase by a compound annualized growth rate of 2.5%, reaching $173.2 in 2022 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Bread sales will continue to dominate the bakery market. In 2022, bread sales are expected to account for $4.2 billion (USD) or almost 64% of baked goods sales that years (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

Source: Agriculture and Agri-Food Canada. (2018). Sector Trend Analysis – Baked Goods in the United States and Canada. Retrieved from: http://www.agr.gc.ca/eng/industry-markets-and-trade/international-agri-food-market-intelligence/reports/sector-trend-analysis-baked-goods-in-the-united-states-and-canada/?id=153738127203

Business Locations

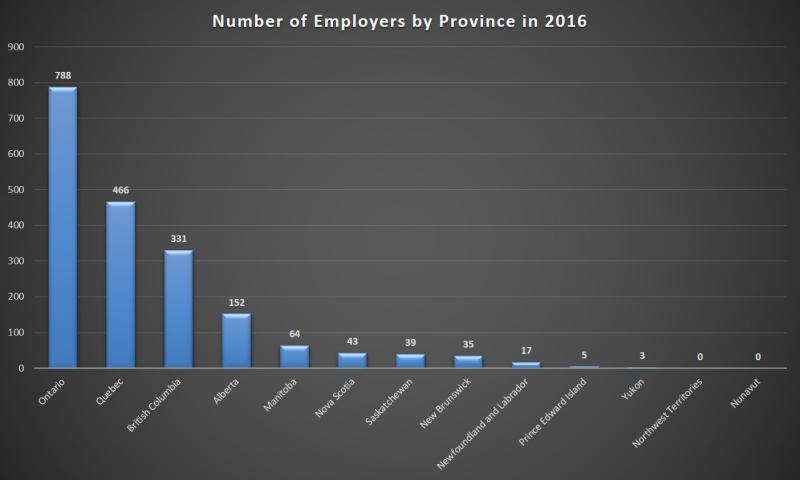

In 2016, 81.4% of industry employers were located in three provinces: Ontario, Quebec, and British Columbia. Quebec was Canada’s top employer with a total of 788 establishments that year.

Source: Statistics Canada. Establishments by Employment Type and Province/Territory (2016). Retrieved from: https://www.ic.gc.ca/app/scr/app/cis/businesses-entreprises/3118

As shown in the table below, the majority of industry establishments were small establishments that employed between 5-99 employees. Overall, these small establishments accounted for 67.9% of all industry establishments in 2016.

|

Province/Territory |

Micro (1-4) |

Small (5-99) |

Medium (100-499) |

Large (500+) |

|

Ontario |

218 |

518 |

52 |

0 |

|

Quebec |

120 |

322 |

23 |

1 |

|

British Columbia |

90 |

225 |

16 |

0 |

|

Alberta |

41 |

107 |

4 |

0 |

|

Manitoba |

15 |

47 |

2 |

0 |

|

Nova Scotia |

14 |

27 |

2 |

0 |

|

Saskatchewan |

8 |

30 |

1 |

0 |

|

New Brunswick |

7 |

26 |

2 |

0 |

|

Newfoundland and Labrador |

6 |

10 |

1 |

0 |

|

Yukon |

1 |

2 |

0 |

0 |

|

Northwest Territories |

0 |

0 |

0 |

0 |

|

Nunavut |

0 |

0 |

0 |

0 |

|

Prince Edward Island |

0 |

0 |

0 |

0 |

|

Canada |

520 |

1322 |

103 |

1 |

|

Percentage distribution % |

26.7 |

67.9 |

5.3 |

0.0 |

Source: Statistics Canada. Establishments by Employment Size Category and Province/Territory (2016). Retrieved from: https://www.ic.gc.ca/app/scr/app/cis/businesses-entreprises/3118

Trends and Changes

Health conscious consumers

- Canadians prefer bakery products that are not only more natural, but also contain less preservatives. As a result, more Canadians are moving away from highly-processed products (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Canadians desire accurate information to make informed purchasing decisions (especially for gluten-free products) (Allergen Control Group, 2017).

- More Canadians are watching their sugar and salt intake due to concerns over diabetes and high blood pressure (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2018).

- Increasing popularity of Ketogenic and Paleo diets means that more Canadians are cutting back on their carbohydrate intake (Bell, 2019).

- Canadian bakery industry is responding to health concerns and consumer trends by increasing the range of baked goods (eg. gluten-free) produced as well as highlighting the health benefits (eg. reduced/low fat) of those goods (Bell, 2019).

Growing awareness of Celiac disease

- 350,000 Canadians or 1% of the national population has Celiac disease (Agriculture and Agri-Food Canada, “Gluten Free”, 2014).

- Individuals with Celiac disease must maintain a strict-gluten free diet. As such, they are unable to eat bagels, cakes, doughnuts and other primary products of the Canadian bakery industry (Health Canada, 2018).

- Despite their relatively small size, Canadians with Celiac disease represent an important and growing segment of the market for gluten-free products (Agriculture and Agri-Food Canada, “Gluten Free”, 2014; Health Canada, 2018).

Gluten-free consumer demands

- Gluten-free remains the fastest type of food intolerance category in Canada (Agriculture and Agri-Food Canada, “Gluten Free”, 2014).

- Meeting the demand for gluten-free products may be the biggest challenge facing today’s bakers. This is because more bakers are having to experiment with new (and expensive) alternative grains and flours to create gluten-free products that are flavourful (Bell, 2019).

- Canadian baking schools are having to adapt their curriculum to help better prepare future bakers to meet the reduced/no gluten demands of consumers (Bell, 2019).

- Canadians are willing to pay more for gluten-free products. However, there is strong pressure to make these products more affordable for consumers (Allergen Control Group, 2017).

Sources

Agriculture and Agri-Food Canada. (2018). Sector Trend Analysis – Baked Goods in the United States and Canada. Retrieved from: http://www.agr.gc.ca/eng/industry-markets-and-trade/international-agri-food-market-intelligence/reports/sector-trend-analysis-baked-goods-in-the-united-states-and-canada/?id=1537381272039

Agriculture and Agri-Food Canada. (2014). “Gluten Free” Claims in the Marketplace. Retrieved from: http://www.agr.gc.ca/eng/industry-markets-and-trade/canadian-agri-food-sector-intelligence/processed-food-and-beverages/trends-and-market-opportunities-for-the-food-processing-sector/gluten-free-claims-in-the-marketplace/?id=1397673574797

Allergen Control Group. (2017, January 24). Demand for Gluten-free Foods Expected to Substantially Increase as Awareness and Diagnosis of Celiac Continues to Rise. CISION. Retrieved from: https://www.newswire.ca/news-releases/demand-for-gluten-free-foods-expected-to-substantially-increase-as-awareness-and-diagnosis-of-celiac-disease-continue-to-rise-611631355.html

Bell, E. (2019, March 22). Bread Trends for 2019. Bakers Journal. Retrieved from: https://www.bakersjournal.com/news/bread-trends-for-2019-7674

Health Canada. (2019). Celiac Disease: The Gluten Connection. Retrieved from: https://www.canada.ca/content/dam/hc-sc/documents/services/food-nutrition/reports-publications/food-safety/celiac-disease-gluten-connection/26-18-2047-Food%20Allergen-Celiac-EN-FINAL.pdf

Statistics Canada. (2016). Establishments by Employment Size Category and Province/Territory. Retrieved from: https://www.ic.gc.ca/app/scr/app/cis/businesses-entreprises/3118