Key Takeaways (Industry Status?)

- Modest Growth: The Canadian bakery product market grew by a compound annualized rate of 3.3% during 2017-2022 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

- Modest Outlook: The Canadian bakery product market is expected to grow at a compound annualized rate of 3.5% to 2026 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

- Health and Wellness Trends: Gluten-free is the fastest growing food intolerance category in Canada. Celiacs as well as health-conscious individuals are expected to drive growth of products labeled organic and gluten-free, which are expected to grow at a CAGR of 4.4% (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

- Brick and Mortar Accessibility: Retail sales have rebounded from a low in 2020 as Canadians spend more time outside and in their neighborhoods. However, uncertainty as to whether there might be a resurgence of coronavirus, even three years later, looms in the Canadian market. A resurgence would benefit sales of frozen baked goods while inflicting damage on brick-and-mortar retailers (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

Industry Performance Snapshot

During 2017-2022:

- Canada was the world’s twelfth largest market for baked goods, and experienced modest growth, growing at a compound annual rate (CAGR) of 3.3% (Agriculture and Agri-Food Canada, Sector Analysis, 2021).

- Consumers’ taste for both unpackaged, artisanal bread and pastries grew over this time period, growing to $1.1 billion USD and $708 million USD in 2022 respectively.

- The size of the specialty foods industry and the number of players within it grew with rising disposable incomes and higher consumer spending across all grocery retail channels, to about $3.8 billion in 2022. Spending in this industry outpaced retail spending on average in most years (Buchko, IBISWorld, 2021).

- Consumer preferences for healthy alternatives, gluten-free options, and all-natural and organic foods helped fuel the performance of the specialty foods industry, both at brick-and-mortar stores and at competitors like online grocery retailers (Buchko, IBISWorld, 2021).

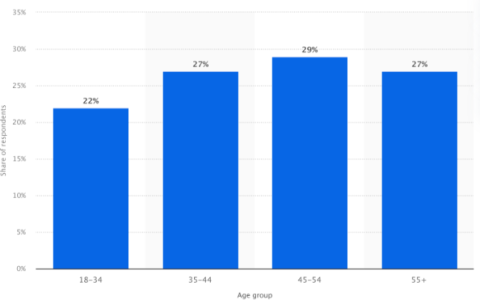

Over 25% of consumers in each age group believed artisanal products were worth paying more for (Statista, 2017).

Source: Statista, Consumers who think it is worth paying more for artisanal or craft bread in Canada as of May 2017, by age group. Retrieved from Statista database.

Industry Outlook

For the period 2023- 2027:

- The Canadian bakery product market is expected to grow at a compound annualized rate of 3.5% to 2026 (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

- In the specialty foods industry, Canadian consumers’ taste for natural, organic, premium, and gluten-free products, as well as artisanal products, will drive growth at a CAGR of 2.0% year-over-year (Buchko, IBISWorld, 2021).

- In both industries, industry operators are expected to endure intensifying competition from mainstream grocery stores expanding their bread and pastry product selection, supermarkets and other retail channels such as online retailers (Buchko, IBISWorld, 2021).

Business Locations

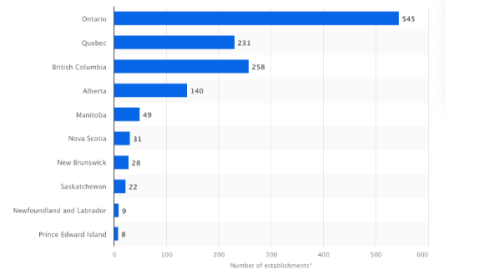

Competition among bakeries and bakery product manufacturing locations in Canada is high. British Columbia comes in third for number of bakeries by region, boasting 258, of which 174 are bakeries (Statista, Number of retail bakeries in Canada as of December 2022, by region, 2023.)

Source: Statista. Number of bakery product manufacturing establishments in Canada as of December 2022, by region. Retrieved from Statista database.

Industry Trends and Challenges

Health-conscious consumers: Gluten-free consumers are a small but important segment of the market. These consumers, as well as health-conscious consumers who desire organic, whole-wheat, and sprouted bread products and pastries, are a growing cadre, as evidenced by the fact that Canada sells the third-most health and wellness bakery products in the world (Agriculture and Agri-Food Canada, Sector Trend Analysis, 2021).

Stagnation in mature markets: Consumption of bread and bakery products in mature markets such as North America is expected to be relatively stagnant, while changes to a Western-style diet in North Asian countries increase demand for savory bread products and the GDP of Brazil, India, Russia, and China supports rising demand. Increase in consumption in these mature markets will be driven by organic, sprouted, and gluten-free products (Koronios, IBISWorld, 2021).

Inflationary and supply chain pressures: Although the price of bread and sugar are both expected to decline through 2028 (Kanda, IBISWorld, 2023) inflation above 4% in Canada has put pressure on Canadians’ disposable incomes, and supply chain issues from COVID linger.

Cultural milieu: Small retailers, often brick-and-mortar ones, may rely on neighbourhood green spaces, the ability to host patios, or walking accessibility to draw customers into their stores. A patio/cafe culture is rarer in North America than places like Europe, leading these retailers to develop a differentiated social media presence for multi-channel marketing. Business associations can help these retailers and bakeries find an appropriate location as well.

Sources

Buchko, M. (2022, September). Specialty Food Stores in Canada: Industry Report 44529CA. IBISWorld. Retrieved from IBISWorld Industry Reports.

Government of Canada. (2021). Sector Trend Analysis- Bakeries in Canada. Government of Canada.https://agriculture.canada.ca/en/international-trade/market-intelligence/reports/sector-trend-analysis-bakery-products-canada

Kanda, S. (2021, December). Bread Production in Canada: Industry Report 31181CA. IBISWorld. Retrieved from IBISWorld Industry Reports.

Koronios, E. (2021, March). Global Bakery Goods Manufacturing: Industry Report C1114-GL. IBISWorld. Retrieved from IBISWorld Industry Reports.

Wunsch, N-G. (2023, April 26). Number of bakery product manufacturing establishments in Canada by region 2022. StatCan. Retrieved from Statista database.

Wunsch, N-G. (2022, January 14). Retail sales of unpackaged or artisanal bread in Canada from 2013 to 2022, by type, in millions of US dollars. Statista. Retrieved from Statista database.

Wunsch, N-G. (2022, January 14). Retail sales of unpackaged or artisanal pastries in Canada from 2013 to 2022 in millions of US dollars. Statista. Retrieved from Statista database.

Wunsch, N-G. (2020, November 24). Canadian consumer willingness to pay more for artisanal or craft bread by age 2017. Canadian Food Business. Retrieved from Statista database.