Complementary and Alternative Medicine (CAM) is a diverse field that encompasses health care practices and products not considered to be conventional or mainstream. This industry overview will highlight statistics and trends for CAM in Canada. Data has primarily been drawn from the Fraser Institute, Canada’s top think-tank and the only organization in the country that has conducted a comprehensive study of CAM usage in Canada. For a definition of CAM please click here.

Photo Credit: Photo by Monika

Key Takeaways

- Domestic Demand: Canadians spent a total of $8.8 billion on CAM in 2015-2016. This was an $800 million increase from 2005-2006 (Esmail, 2017).

- Regional Variation: CAM usage is generally higher in Western Canada than in Eastern Canada (Esmail, 2017).

- Health Product Exports: Health product exports nearly doubled (93%) during 2015-2016. Natural health products (NHP) were the key drivers of this growth (CHPA, 2016).

- Strong Global Reputation: Canada continues to have an excellent global reputation as a supplier of high quality Functional Foods and Natural health Products (FFNHP) (Agriculture and Agri-Food Canada, 2014).

Industry Performance Snapshot

According to the Fraser Institute’s most recent survey on CAM usage in Canada:

- Canadians spent $6.5 billion on providers of CAM, and an additional $2.3 billion on natural health products (eg. herbs and vitamins), dietary programs, books, classes during 2015-2016 (Esmail, 2017).

- Approximately 56% of Canadians used at least one CAM therapy during 2015-2016 (Esmail Institute, 2017).

- Massage (24%), relaxation techniques (19%), chiropractic care and yoga (16%), and spiritual healing (15%) were the most commonly used CAM therapies during 2015-2016 (Esmail, 2017).

- Approximately 65% of British Columbians and Albertans used CAM therapies in 2016, compared to 52% of Atlantic Canadians and 46% of Quebecers (Esmail, 2017).

For more information on Cannabis in Canada, see our Cannabis Legalization Series.

Industry Outlook

For the period 2019-2024:

- Canadians are expected to benefit from a 2.7% increase in disposable income. As a result they will have more money to spend on their well-being (Couillard, 2019).

- Total health expenditure is forecasted to increase at an annualized rate of 3% to 190.3 billion (Couillard, 2019).

- Rising expenditure is expected to result in more Canadians choosing preventative care as well as CAM therapies like homeopathy (Couillard, 2019).

- Growth in CAM, combined with the growing health consciousness of Canadians and their willingness to spend more on their well-being will boost revenues for related industries like the Health Store industry (Couillard, 2019).

Products and Services

This image from the Fraser Institute’s most recent study on CAM shows the various types of treatments/therapies and their usage in Canada. Data for the territories was not provided by the Fraser Institute.

Source: Esmail, N. (2017). Complementary and Alternative Medicine: Use and Public Attitudes 1997, 2006, 2016. Fraser Institute.

Key Markets

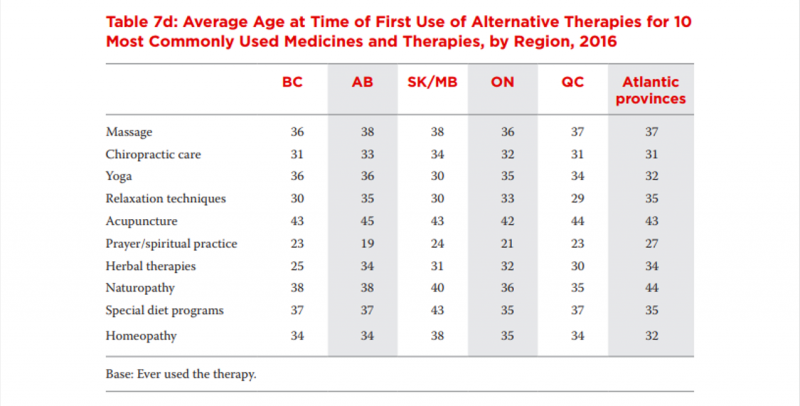

The Fraser Institute estimates that in 2016 most CAM users were between 35-44 years of age (Esmail, 2017). The average age of first time CAM users is shown below.

Source: Esmail, N. (2017). Complementary and Alternative Medicine: Use and Public Attitudes 1997, 2006, 2016. Fraser Institute.

Trends and Changes

Rising Health Care Expenditure

- Total health expenditure is expected to rise by 4.2% to reach $6,839 per person in 2018 (CIHI, 2018).

- Total health expenditure per person will vary from $6,597 in British Columbia and $6,584 in Ontario to $7,552 in Alberta and $7,443 in Newfoundland and Labrador (CIHI, 2018).

- Approximately 70% of total health expenditure in 2018 will come from public-sector funding. The remaining 30% will be privately funded and will include complementary and alternative therapies and medicinal products (CIHI, 2018).

- Hospitals (28.3%), drugs (15.7%) and physician services (15.1%) are expected to account for the largest share of health dollars moving forward (CIHI, 2018).

Healthy Eating

- 84% of Canadians believe that what they eat has a direct impact on their physical health (Powell, 2017).

- 63% believe that what they eat affects their emotional well-being (Powell, 2017).

- 80% of women compared to 72% of men say they eat healthy (Powell, 2017).

- 45% of Canadians are interested in trying the latest foods that claim to boost health. This bodes well for the Complementary and Alternative Medicine industry (Powell, 2017).

Photo Credit: Photo by Silvia Rita

Consumer Preferences

- Canadians prefer to buy products that are linked to specific health outcomes (eg. cardiovascular health) (Agriculture and Agri-food Canada, 2015).

- Canadians place a premium on products that align with their personal values (eg. animal welfare) and are less willing to purchase those that do not (Agriculture and Agri-food Canada, 2015).

- Canadians value transparency and clear labels that clearly communicate a product’s benefits (Agriculture and Agri-food Canada, 2015).

- More Canadians are wary of dubious health claims online (Lindsay, 2018).

Cannabis Industry Experiences Growing Pains

-

Cannabis market has suffered a 20% fall since legalization in October 2018 (PWC Canada’s Cannabis Series, Chapter 6, n.d.).

- Canadian cannabis industry continues to struggle with overcapacity, weak business structures, and inexperienced management teams (PWC Canada’s Cannabis Series, Chapter 6, n.d.).

- More licensed producers are looking to expand into international markets. The extent to which these exports will support overcapacity in Canada is unclear. (PWC Canada’s Cannabis Series, Chapter 6, n.d.).

Sources

Agriculture and Agri-Food Canada. (2015). Emerging Food Innovation: Trends and Opportunities. Retrieved from: http://www.agr.gc.ca/resources/prod/doc/pdf/emerging_food_innovations_innovations_alimentaires_emergentes-eng.pdf

Agriculture and Agri-Food Canada. (2014). Opportunities and Challenges Facing the Canadian Functional Foods and Natural Health Products Sector. Retrieved from: http://www.agr.gc.ca/resources/prod/doc/pdf/ffnhp_opportunities_challenges_afpsn_possibilites_defis-eng.pdf

CHPA. (2016). North American Trends in the Consumer Health Product Industry. Retrieved from: https://www.chpcanada.ca/wp-system/uploads/2017/12/CHPC-CHPA-RCC-Submission-2016-FINAL.pdf

CIHI. (2018). National Health Expenditure Trends, 1975 to 2018. Retrieved from: https://www.cihi.ca/sites/default/files/document/nhex-trends-narrative-report-2018-en-web.pdf

Couillard, L. (2019). IBISWorld Industry Report 44619CA: Health Stores in Canada. Retrieved from IBISWorld Industry Reports database.

Esmail, N. (2017). Complementary and Alternative Medicine: Use and Public Attitudes 1997, 2006, and 2016. Retrieved from: https://www.fraserinstitute.org/sites/default/files/complementary-and-alternative-medicine-2017.pdf

Lindsay, B. (2018, June 9). There’s an Epidemic of Bogus Health Claims Online, and No Easy Cure. CBC. Retrieved from: https://www.cbc.ca/news/canada/british-columbia/there-s-an-epidemic-of-bogus-health-claims-online-and-no-easy-cure-1.4695898

Powell, C. (2017, March 3). Healthy Eating Becoming Increasingly Important to Canadians: Study. Canadian Grocer. http://www.canadiangrocer.com/research/healthy-eating-becoming-increasingly-important-to-canadians-study-71343

PwC Canada. (n.d). Chapter 6 – Restructuring: The Growing Pains of a New Industry. Retrieved from: https://www.pwc.com/ca/en/industries/cannabis/pwc-cannabis-series-chapter-6-restructuring.html

The Conference Board of Canada. (2015). Healthy Growth: Estimating the Economic Footprint of the Fast Growing Consumer Health Products Industry. Retrieved from: https://www.chpcanada.ca/sites/default/files/healthy_growth_final_report.pdf