Online retail refers to the purchase of goods over the internet. Some retailers may operate both brick and mortar stores as well as offering an online retail service. Online retail can also include the sale of goods via online auction houses, or third party merchants who sell their products via sites such as Amazon and eBay. Online retail can also be referred to as ecommerce, internet shopping, online retail and electronic shopping.

For more specific information on researching the online retail industry please see our Online Retail Accelerator Guide.

For more specific information about related industries please see our industry guides for clothing retailer, grocery store, and wholesale retail.

A note on statistics: it is important to note that online retail statistics vary widely depending on whether they include purchases from only online domestic providers, or all online purchases. This overview will focus mainly on domestic providers to domestic purchasers. Total online retail figures would be considerably higher if overseas providers were included.

Content

- Industry Status

- Industry performance summary

- Positive industry indicators

- Organizational challenges

- Costs

- Employment

- Trends & changes

- Resources

Industry Status

Industry phase: Growth

Barriers to entry: Low

Concentration: Medium

Regulation: Medium

Competition: High

(Ozelkan, 2018)

Industry performance summary

Canada has been much slower to adopt online retail than many other nations, most noticeably the US (KPMG, 2018). This has been attributed to a number of causes, firstly that majority of the population live in urban areas where access to stores is relatively easy, compared to a more suburban US population (Ozelkan, 2018). Secondly, that Canadian retailers have been relatively slower to adopt and invest in online sales channels. This means there is still substantial room for growth within the industry.

Although online retailers do not require a physical shopfront, British Columbia and particularly Vancouver – is still a prime location for online retail business. Major provinces for online shopping include Ontario, which accounts for 46.8% of establishments, British Columbia, which accounts for 19.8% and Quebec, 16.4%. (Ozelkan, 2018)

The graph below shows both all retail ecommerce sales (including companies who also have brick and mortar stores) and sales from exclusively electronic and mail order houses from January 2016 - December 2018.

Source: Statistics Canada. June 2018. Table 20-10-0072-01. Retail E-commerce sales, unadjusted (x 1,000). CANSIM (database). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2010007201 (accessed March 14, 2019)

Positive industry indicators

Market Growth

Retail ecommerce sales in Canada have risen sharply in recent years and this growth is set to continue

- Annual Growth 2013 – 2018 20.5%

- Annual Growth 2018 – 2023 8.5%

(Ozelakan 2018)

High demand for domestic products

62% of Canadians prefer to buy on Canadian websites over American websites. This is primarily due to: benefiting the Canadian economy (44%); offering cheaper and more predictable delivery (19%); the low Canadian dollar compared with the US dollar (17%); and not having to worry about paying customs charges (16%) (CIRA, 2018). According to eMarketer the share of domestically sourced goods being bought by online shoppers is increasing because of better local options, currency exchange and international shipping costs.

Technological advances

There are a number of technological advances that have benefited the online retail industry. As more people have reliable connections (CTRC, 2017) and devices become cheaper, the potential purchasing population has grown. As of 2017, 92.7% of Canadian’s use the internet, compared to 73.2% a decade earlier (International Telecommunication Union). This is set to continue in BC with significant government investment in expanding and improving internet connectivity in rural communities. As people have become more familiar with the technology involved, security concerns have decreased and comfort levels have risen (CIRA, 2018). Convenience has also grown with the rise of one-click purchasing either built into websites or available via third parties such as Paypal. Having said that, online retailers must continue to invest in order to stay on top of technological changes.

Demographics

eMarketer estimates 60.9% of the population in Canada made at least one purchase via a digital channel in 2017. For younger millennials, aged 18 to 24, the penetration rate was 75.0% - well above the total average - as it was for residents ages 35 to 44 (74.3%). But providers shouldn’t discount other generations, with 35% of Canadian shoppers aged 50-69. When considering demographics it’s important to consider both the number of shoppers and their spending power.

Organizational challenges

Consumer expectations

Consumer expectations are high and continue to grow and experiences are not living up to expectation. A recent Retail Council of Canada report states that 55% of people experience a problem purchasing online, compared to 31% purchasing in store. Key considerations when meeting consumer expectations include:

- Rapid shipping speeds

- Excellent customer service

- Generous returns policy

According to research from Radial, 49.3% Canadians avoid buying from online retailers who do not offer free returns, while another survey from Canada Post reported that 34% of Canadian millennials would not shop with a retailer again if they had a bad delivery experience.

Barriers to success

Barriers to entry into the industry are relatively low, with the rise of services such as Shopify, eBay and Amazon making it increasingly easy for anyone to start selling online. However, barriers to success (i.e. the ability to stay profitable and in operation for more than a few initial years) are relatively high. Larger players will benefit from economies of scale and pre-existing relationships with suppliers (Marketline, 2016).

Increasing competition

Attracted by growing demand, over the five years to 2023, the number of operators in this industry is predicted to grow at an annualized rate of 10.9% to 5,901 companies. (Ozelakan 2018).

Traditional brick and mortar retailers are also expected to catch up with demand for online retail. Online operators should ensure that their product range is as extensive, if not more extensive, as those found in traditional stores. This will entice consumers to turn to online retailers for hard to find items (Ozelkan 2018)

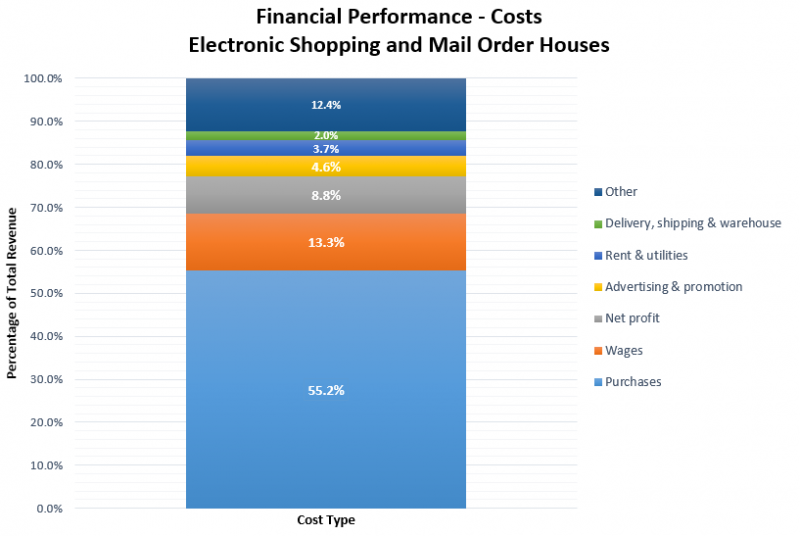

Cost breakdown

Source: Statistics Canada. (2016). Report for: NAICS 4511 - Electronic Shopping and Mail-Order Houses - Financial Performance Data (Revenue Range $30K - $5M). Retrieved from: https://www.ic.gc.ca/app/sme-pme/bnchmrkngtl/rprt-flw.pub?execution=e1s1

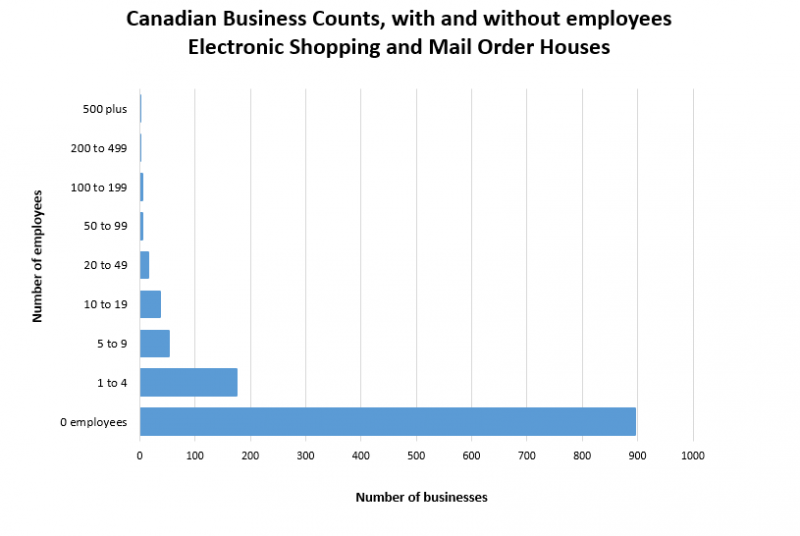

Employment

As illustrated below, the majority of companies in the industry have no employees. Going forward, the number of workers is set to reduce but wages will increase as companies seek skilled employees to grow their businesses, leading to an increase in average salaries. (Ozelkan 2018).

Source: Statistics Canada. June 2018. Table 33-10-0092-01 Canadian Business Counts, with employees, June 2018 , Semi-annual (table). CANSIM (database). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310009201 (accessed January 21, 2019)

Trends & changes

Showrooming vs Webrooming

Showrooming is the practice of browsing goods in bricks and mortar stores and then purchasing them online, typically at a reduced price. Canada is unusual in that the reverse – webrooming – appears to be more popular. This is the practice of browsing online and then travel to a store to purchase the goods in person.

CIRA report that 45% of shoppers 'always or often' browse online and purchase in store, while only 17% 'always or often' browse in store and then shop online. In response, some original online retailers have been going full circle and setting up physical store fronts or pop-ups.

Desktop to mobile

Although desktop purchases still dominate, the percentage of Canadians who use a mobile phone to make an online purchase has risen from 12% in 2014 to 40% in 2018 (CIRA, 2018). Global mobile commerce sales topped $1.3 trillion in 2017, representing 59% of digital sales, up from 40% in 2015 (eMarketer, 2018). Retailers are seeking to reach the rapidly growing number of consumers who shop via smartphones and tablets, with a better mobile experience and app development.

Personalized, multichannel marketing

Personalized marketing, driven by effective use of customer data, is particularly useful to online retailers. Based on demographics and behaviour, online ads can be delivered to attract new customers and also to increase purchase rates, for example targeting users who abandon their carts prior to purchase. Multichannel marketing also allows companies to interact with customers across a variety of platforms.

Loyalty Programs

Loyalty counts when it is so easy to switch online shopping allegiance, and there are suggestions that loyalty programs need to go beyond merely collecting points and develop into a multichannel experience.

Resources

If you would like to access more resources, the Online Retail Accelerator Guide is designed to help prospective and existing online retail business owners gather information for their secondary market research. The guide is broken down into four main sections that cover how to start your research, industry information, competitive information and customer information. Depending on your needs you can spend as much or as little time as necessary in each section.

If you find that you need more guidance before starting your secondary research, check out our Business Research Basics, it will help you focus on what types of information you will need to gather and why it is important.

Associations

Retail Council of Canada Trade

National Retail Federation (US)

Canadian Internet Registration Authority

Reports

Canadian Internet Registration Authority. (2018). Canada’s Internet Factbook 2018

PWC. (2016). Total Retail Report 2016: Canadian Insights – Personalizing the retail experience.

Retail Council of Canada. (2018). The Blended Commerce Imperative: Insights on today’s consumer with advice and tips for retailers

Canada Post. (2016). Growing E-Commerce in Canada 2016

Industry News

Chain Store Age

Digital Commerce 360

Retail Insider

Webinar

Business Development Bank of Canada How to succeed with e-commerce webinar

Bibliography

Briggs, P., Creaker, S. & Kim, a. (2018) Ecommerce in Canada 2018: eMarketer’s Latest Forecast, with a Focus on Grocery. eMarketer

Hemmadi, M. (Nov 27, 2014). Why Canada has a serious e-commerce problem, in one infographic. Canadian Business. Retrieved from https://www.canadianbusiness.com/innovation/canada-serious-e-commerce-problem-infographic

KPMG. (2018). Canadian Retailers Stepping up to Disruption, but feeling the pressure of the new "normal". Retrieved from: https://assets.kpmg/content/dam/kpmg/ca/pdf/2018/12/tom-2018-canadian-viewpoint.pdf

Marketline Industry Profile. (2016). Online Retail Industry Profile: Canada. Marketline: London

Mohammad, Q. (July 10, 2018). Canada’s e-commerce ecosystem continues its rise. The Globe and Mail. Retrieved from: https://www.theglobeandmail.com/business/commentary/article-canadas-e-commerce-ecosystem-continues-its-rise

Ozelkan, E. (2018). Industry Report 45411aCA, E-Commerce & Online Auctions in Canada. IBISWorld Inc.

eMarketer. (2018). Retail ecommerce performance metrics, Canada Q3 2018.

International Telecommunications Union. (2018). Percentage of Individuals Using the Internet. Retrieved from https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx

Passport GMID. (2018). Internet Retailing in Canada Country Report.

Radial Inc. (2018). Cracking the Code: What Online Shoppers Value Most. Retrieved from: https://www.radial.com/insights/study-reveals-what-consumers-value-most?download_authorized=1

Statistics Canada. (June 2018). Table 33-10-0092-01 Canadian Business Counts, with employees, June 2018 , Semi-annual (table). CANSIM (database). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310009201 (accessed January 21, 2019)

Statistics Canada. (2016). Report for: NAICS 454110 - Electronic shopping and mail-order houses - Financial Performance Data (Revenue Range $30K - $5M). Small business profiles, 2016. Last Updated 13 April 2018. https://www.ic.gc.ca/app/sme-pme/bnchmrkngtl/rprt-flw.pub?execution=e1s1&lang=eng (accessed February 28, 2019)

Statistics Canada. (2018). Table 20-10-0072-01. Retail E-commerce sales, unadjusted (x 1,000). CANSIM (database). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2010007201 (accessed 14 March, 2019)

The Canadian Radio-television and Telecommunications Commission. (2017). Communications Monitoring Report 2017: Canada’s Communication System: An Overview for Canadians. Retrieved from: https://crtc.gc.ca/eng/publications/reports/policymonitoring/2017/cmr2.htm