This industry overview will discuss the latest statistics and trends for the management consulting industry in Canada. For more information on the consulting industry please see our Consulting Industry Guide.

Photo Credit: Photo by Free-Photos

Key Takeaways

- Steady growth: The number of consulting firms grew every year during 2013-2018. This is expected to continue through 2018-2023.

- New entrants: High industry profitability will incentive new entrants into the market during 2018-2023. Many of these new entrants will serve niche industries.

- Steady competition: Competition is expected to remain steady during 2018-2023, with the main sources of competition coming from the IT consulting industry and in-house service.

- Stable demand: Strong domestic economic conditions are expected to result in stable demand for industry services during 2018-2023.

Industry Performance Snapshot

The Management, Scientific and Technical Services Consulting sector [5416] achieved operating revenues and operating expenses of $21.3 billion and $15.3 billion respectively in 2016. (Statistics Canada, Consulting Services, Summary Statistics, n.d.).

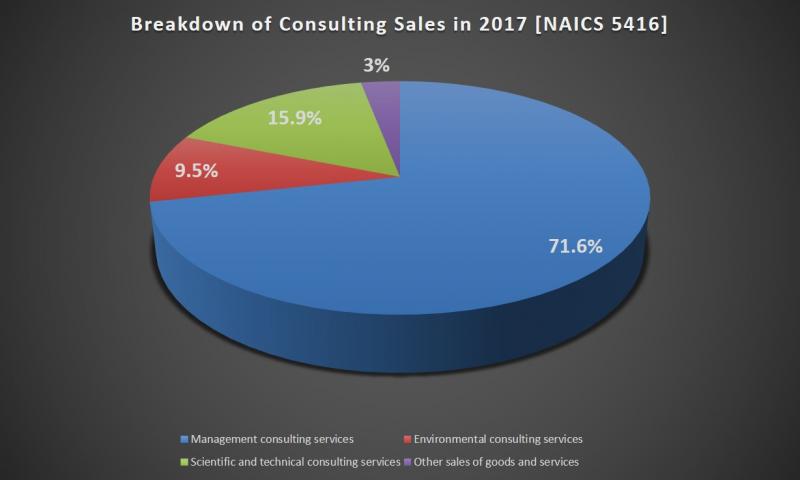

Source: Statistics Canada. Consulting Services, Breakdown of Sales. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310016201

Products and Services

The chart above shows that management consulting services accounted for the largest portion of consulting sales in 2017. The following is a breakdown of the management consulting services provided that year (Statistics Canada, Consulting Services, Breakdown of Sales, n.d.):

- Strategic management consulting services (20.8%)

- Financial management consulting services (10.6%)

- Marketing management consulting services (5.5%)

- Human resources management consulting services (12.0%)

- Operations and supply chain management consulting services (4.2%)

- Other management consulting services (18.5%)

Key Markets

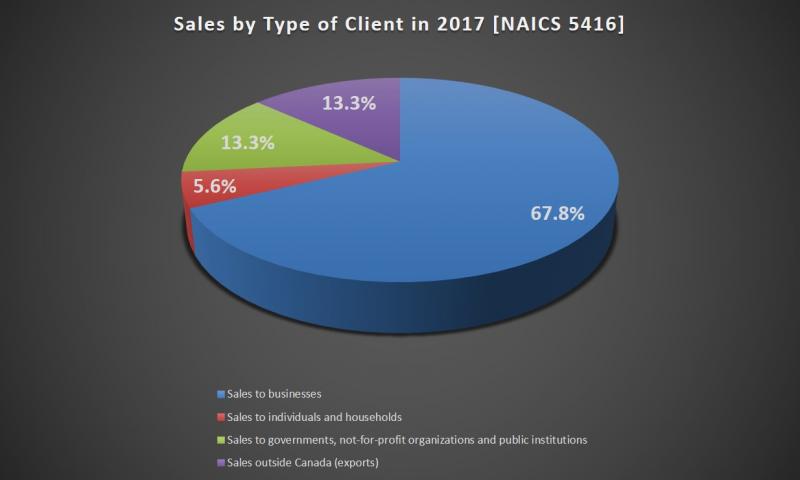

In 2017, most sales were made to domestic businesses (67.8%), followed by sales to governments, not-for-profit organizations and public institutions (13.3%) and sales to international clients (13.3%).

Source: Statistics Canada. Consulting Services, Sales by Type of Client. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2110016801

Cost Breakdown

The Top 5 industry expenses in 2017 were (Statistics Canada, Consulting Services, Industry Expenditures, n.d):

- Salaries, wages, commissions, and benefits (43.2%)

- Subcontracts (9.2%)

- Professional and business fees (7.4%)

- Cost of goods sold (6.4%)

- All other costs and expenses (9.9%)

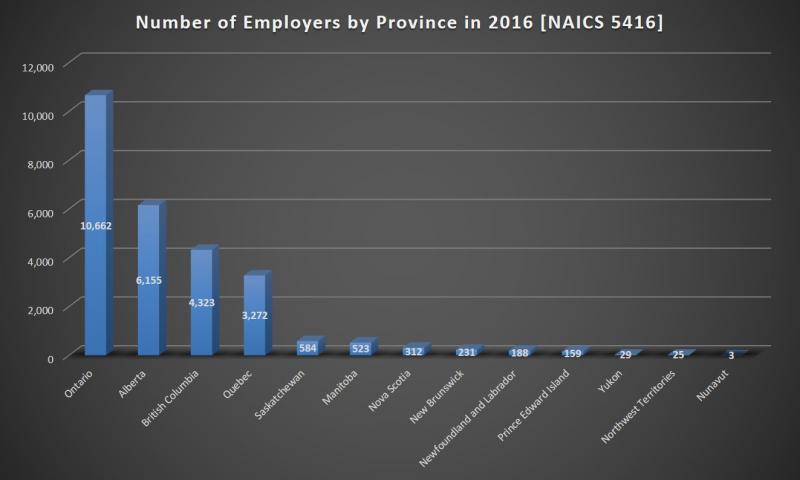

Business Locations

Source: Statistics Canada. Establishments by Employment Type and Province/Territory. Retrieved from: https://www.ic.gc.ca/app/scr/app/cis/businesses-entreprises/5416

Trends & Changes

Market Growth

- During 2018-2023, government expenditure is forecast to grow at an annualized rate of 1.7%. This will create more opportunities for management consultants who specializing in advising public agencies (Ismailanji, 2018)

- Financial services will be a key driver of industry demand during 2018-2023. Management consultants will benefit as a result of Canadian banks and firms seeking their services (Ismailanji, 2018).

Steady Competition

- During 2018-2023, more specialized consulting firms will enter the market and provide services to niche industries (Ismailanji, 2018).

- High industry profitability will lead to more competition, with the total number of enterprises reaching 87,390 by 2023 (Ismailanji, 2018).

Shifting Business Environment

- During 2018-2023, foreign investment is expected to slow as a result of the US Tax Cuts and Jobs Act (Ismailanji, 2018).

- Corporate profit and the number of businesses in management consulting are forecasted to increase at annualized rates of 4.8% and 0.7% respectively, creating strong demand for industry services (Ismailanji, 2018).

Growth of the Gig Economy

- The gig economy (characterized by temporary or contracted employment on an on demand basis) is growing rapidly in Canada (BMO, 2018).

- Large corporations are hiring more consultants and highly skilled specialists to supplement their permanent staff (BMO, 2018).

- In September 2017, there were 2.8 million Canadians classified as temporary workers (BMO, 2018). This figure includes management consultants.

- Millennials are more attracted to the gig economy than other age groups because they are looking for ways to supplement their income (BMO, 2018).

Other Trends

- Management consultants are developing niche proficiencies and more dynamic skill sets. Being a generalist is less common (CMC, 2016).

- Big data continues to create new opportunities in information usage, governance, data security, and privacy and information systems (CMC, 2016).

- Clients are demanding value-based solutions and proof of cost savings. They also expect to be mentored and coached by their consultants (CMC, 2016).

Snapshot of British Columbia

- Largest age group of consultants were 45-64 (50%), followed by 25-44 (39%), 65+ (9%), and 15-24 (2%) (WorkBC, n.d.).

- 74.7% of all management consultants worked in the Mainland/Southwest regions of BC (WorkBC, n.d.).

- Annual median salary of consultants was $75,082 in 2017 (WorkBC, n.d.).

- Provincial hourly wage rate (WorkBC Industry Outlook Profile, 2018):

- High: $51.43

- Median: $36

- Low: $20

- 530 management consulting jobs opened in 2018 (WorkBC, n.d.).

- 4233 people are currently employed in this sector (WorkBC Industry Outlook Profile, 2018).

- 2126 new job openings are forecasted for 2018-2028, with annual forecasted replacement rates of 2.7% (WorkBC Industry Outlook Profile, 2018).

Sources

BMO Wealth Management. (2018). The Gig Economy. Retrieved from: https://www.bmo.com/assets/pdfs/wealth/bmo_gig_economy_report_en.pdf

CMC Canada. (2016). Management Consulting in Canada: 2016 Industry Report – Executive Summary. Retrieved from:

https://higherlogicdownload.s3.amazonaws.com/CMCCANADA/6ae61369-ed65-4d46-87b4-976096e78fa2/UploadedImages/Executive%20Summary%20-%202016%20Industry%20Study.pdf

Ismailanji, M. (2018). IBISWorld Industry Report 54161CA: Management Consulting in Canada. Retrieved from IBISWorld Industry Reports database.

Statistics Canada. (n.d). Consulting Services, Breakdown of Sales. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310016201

Statistics Canada. (n.d.). Consulting Services, Industry Expenditures. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2110016701

Statistics Canada. (n.d.). Consulting Services, Sales by Type of Client. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2110016801

Statistics Canada. (n.d.). Consulting Services, Summary Statistics. Retrieved from: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2110016601

WorkBC. (2018). WorkBC Industry Outlook Profile: Management, Scientific and Technical Consulting Services (NAICS 5416). Retrieved from: https://www.workbc.ca/getmedia/13b75e6f-8609-4e28-a965-eac561743fc3/profile-5416-management,-scientific-and-technical-consulting-services.pdf.aspx

WorkBC. (n.d.). Professional Occupations in Business Management Consulting (NOC 1122). Retrieved from: https://www.workbc.ca/jobs-careers/explore-careers/browse-career-profile/112